PM Svanidhi scheme 2024:The PM Svanidhi Scheme, launched in 2020, has been a lifeline for many street vendors in India. In 2024, the scheme continues to empower these small businesses by making it easier for them to access working capital loans. Let’s delve into the details of the scheme and how you can benefit from it.

What is the PM Svanidhi Scheme?

The PM Svanidhi Scheme is a Micro-Credit Facility launched by the Government of India to provide working capital loans to street vendors. It aims to:

- Facilitate access to formal credit for street vendors.

- Encourage timely repayment through interest subsidy.

- Promote digital transactions through cashback incentives.

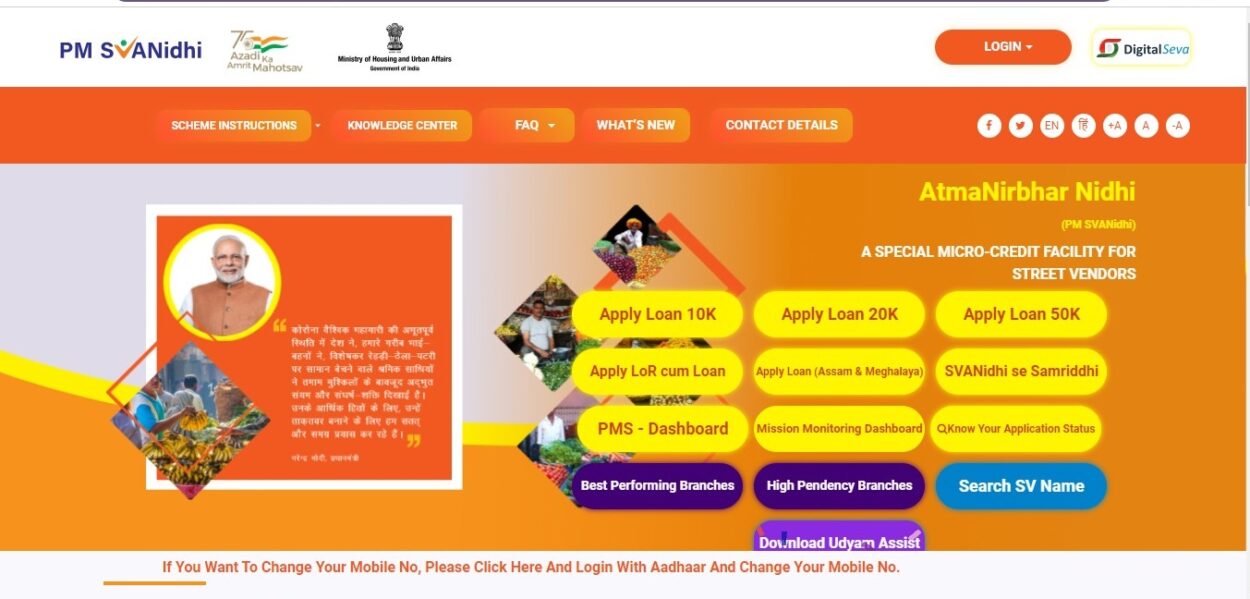

How to apply for PM-SVANidhi Scheme?

Vendors can apply to any government bank to take loan under the PM-SNAVidhi Scheme.

For this, one has to fill the of the PM-SVANidhi Scheme, attach the photocopy of their Aadhaar card and submit it at the bank.

To get the benefit of this scheme, it is mandatory for a vendor to have Aadhar card.

Apart from this, it is also necessary to have a mobile number and a bank account.

Once the loan is approved, the vendor gets the first installment of the loan credited to their account.

How to Apply for a PM Svanidhi Loan

The application process for the PM Svanidhi Loan is designed to be simple and convenient. Here’s a breakdown:

Visit the official PM SVANidhi website – https://pmsvanidhi.mohua.gov.in/

Eligibility Check:

- You must be a street vendor vending for at least one year.

- You should have a valid Identity Card with address proof.

- Preference is given to vendors belonging to the marginalized communities.

Approach a Lender:

- You can apply for the loan through Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Micro Finance Institutions (MFIs) participating in the scheme.

Submit Documents:

- Identity proof (Aadhaar Card, Voter ID etc.)

- Address proof (Ration Card, Electricity Bill etc.)

- A certificate/ vending license from the local Urban Local Body (ULB) or Panchayat, if available.

Loan Approval & Disbursement:

- The lender will process your application and sanction the loan amount.

- The loan is disbursed in three tranches, with increasing amounts based on successful repayment of previous installments.

Documents Required

- Identity proof (Aadhaar Card, Voter ID etc.)

- Address proof (Ration Card, Electricity Bill etc.)

- A certificate/ vending license from the local Urban Local Body (ULB) or Panchayat (if available)

Ministry of Education received 55 proposals for establishing Centers of Excellence (CoEs) in Artificial Intelligence (AI), covering sectors of Agriculture (16), Health (24) and Sustainable Cities (15). In Phase-1, 11 cohorts have been selected to advance to the Proof-of-Concept… pic.twitter.com/fIrPJ7qEO9

— Ministry of Education (@EduMinOfIndia) March 9, 2024

Easier Loan Access in 2024

The focus in 2024 is on simplifying the application process and making it more vendor-friendly. This may involve:

- Streamlining document requirements.

- Increasing awareness about the scheme through outreach programs.

- Potential involvement of NGOs to assist vendors with applications.

Benefits of the PM Svanidhi scheme 2024

- Access to formal credit without collateral.

- Interest subsidy on timely repayment.

- Cashback incentives for digital transactions.

- Builds credit history for future loan applications.

Read More : Govt launches fellowship portal for PhDs, post-doctoral aspirants

Conclusion

The PM Svanidhi Scheme is a game-changer for street vendors in India. With easier access to loans in 2024, vendors can invest in their businesses, expand their inventory, and build financial security. If you’re a street vendor, this scheme can be the key to unlocking your entrepreneurial potential.